Building customer segments that are profitable over the long-term is key to success in business. According to several studies (this old study by Marketing Metrics for example), the probability of selling your products or services to a new customer is 5% to 20% but an existing customer would buy from you 60% to 70% more with the same effort.

You will sell a good number of things to existing customers through out the days/months/years they will spend using your products. The value you generate from your customers during this period is Customer Lifetime Value.

What is Customer Lifetime Value?

We cannot say better than what is already mentioned on the shopify blog:

Customer lifetime value is the total amount of money a customer is expected to spend with your business, or on your products, during the lifetime of an average business relationship. This is an important figure to know because it helps you make decisions about how much money to invest in acquiring new customers and retaining existing ones.

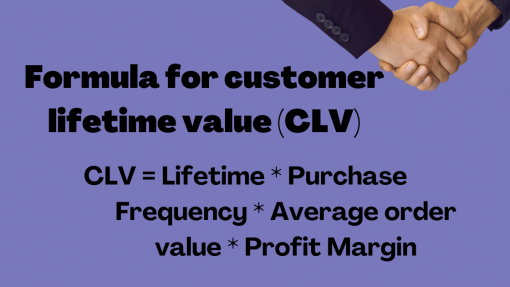

You can use this formula to calculate the Customer Lifetime Value:

How Customer Segmentation helps improve Customer Lifetime Value?

Knowing how customer lifetime is affected by traffic source will help us make better decisions about where we should spend our marketing dollars. Google Analytics allows one to link an order to its origin traffic channel using last-click order attribute. This is a first step towards gaining visibility on different customer segments and their relationship to Custer Lifetime Value. It will allow you to optimise marketing spend.

Demographic, Interest-Based Targeting

To determine the Customer Lifetime Value per targeted advertising segment, it is possible to use demographics and interest trickling from advertising settings. We can optimize targeting settings by looking at segments that have the lowest cost per acquisition and highest customer lifetime value to shift marketing budget to customer segments with the highest return of investment (CLV/CPA).

Zero-Party Data

The Zero-Party Data can help to get a better grasp of customer lifetime value based on the proposition offered to them. In case of significant category expansion, it can help get a hold of the lifetime value of customers acquired because of the new category and how the category expansion impacted customers that could have been obtained without the category expansion.

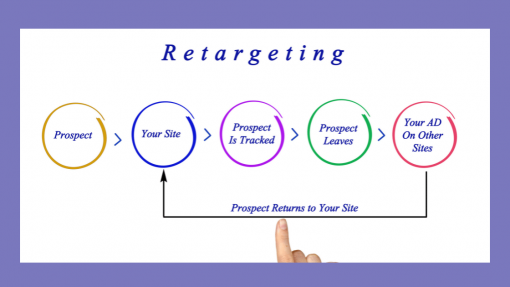

Retargeting

Segmenting leads to better retargeting based on passive behaviour such as Abandoned Cart etc helps in uplifting the customer lifetime value by converting intent into actual purchasing behaviour.

For example on Facebook, you can retarget an audience who have purchased concealer that they have browsed on your website through the creation of a catalogue sales campaign.

Cost per Acquisition (CPA)

It would not be a good business model if your Cost per Acquisition (CPA) were higher than your CLV. Getting a good grasp of the relation between CPA and CLV at the customer level allows us to understand which profile of customers is not profitable or profitable enough and help steer customer acquisition towards the right customer profiles.

Upsell

Having the right understanding of the drivers of customer lifetime values and their expectations at the customer level allow you to provide the right visibility in balancing the cost of offering a retention offer such as addition undertone care products, matching lipsticks etc. This kind of product recommendation can be tailored to the value of keeping a customer based on the need of the customer who is more likely to buy from you because they already trust you